What Is An Offer In Compromise?

Many taxpayers can use an Offer In Compromise (OIC) as a means of resolving their federal tax problems. This means that if someone owes the Internal Revenue Service (IRS) money but is unable to pay the entire amount due, they may be able to offer the IRS a lesser, more manageable sum in settlement. The offer may comprise a single large payment or a series of smaller installments spread out over several months. In contrast to a conventional IRS payment plan, the IRS will forgive the remaining balance of the taxpayer’s debt if it accepts the OIC and the taxpayer makes the agreed-upon payments.

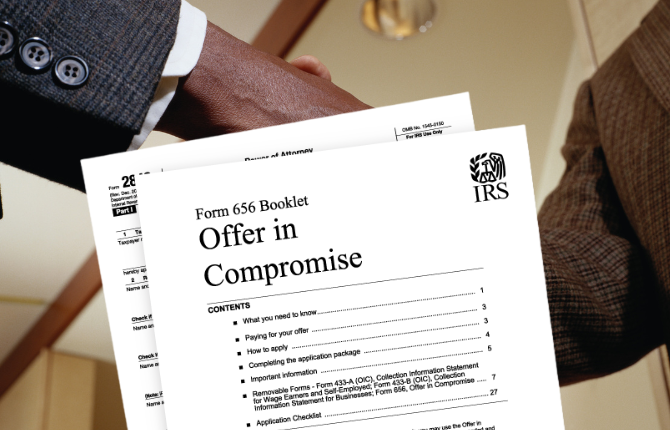

The OIC program is not available to everyone who needs to pay off debt. Taxpayers that qualify must not have an active bankruptcy case and must have filed all of their tax filings. They must also pay an application fee and an initial payment. (Applicants who meet the criteria for low income are exempt from paying a fee or making an initial payment.) To see if they qualify for the OIC program, taxpayers can use a Pre-Qualifier tool on the IRS website. On its website, the IRS offers all the paperwork and guidelines required to submit an OIC; look for “Form 656-B, Booklet” at www.irs.gov/payments/offer-in-compromise.

Although Form 656-B’s full instructions are provided by the IRS, many people find them to be confusing and overwhelming. There are a lot of procedures and documents to complete when requesting an offer in compromise. The Resilient Tax Group’s enrolled agents will make sure you fill out the form correctly and offer guidance to improve your chances of approval. We also make sure the compromise offer is the best course of action for your particular circumstance.

Our agents have a thorough understanding of how the system functions and will put this understanding to use for your advantage. We are ready to assist you in creating a plan of action. Call The Resilient Tax Group; your local Orlando, FL tax advocates who can help you find out if an offer in compromise is right for your situation.

Recent Posts

Read and Explore.

We have a lot of knowledge to share about tax resolution and how it could help your situation. Explore our blog and when you’re ready — reach out to us and book an appointment by clicking HERE or contact us with the information below.

- (321) 732-3229

- hello@theresilienttaxgroup.com

Give Us A Call

(321) 732-3229

Send Us A Message

hello@theresilienttaxgroup.com

Office Location

2462 E Michigan St Suite 208, Orlando, FL 32806